04.02.2026 à 10:29

Beijing’s backtrack on Xinjiang detention camps spurred by ICIJ investigation, research finds

Fergus Shiel

Texte intégral (896 mots)

Reporting by the International Consortium of Investigative Journalists helped force a shift in Beijing’s public stance on Xinjiang, according to new academic research — from denying the existence of a vast detention camp system to justifying it and, eventually, to partially dismantling it.

In an article published in Modern China, a peer-reviewed academic journal dedicated to China studies, political scientist Jan Švec traces how China responded to growing global scrutiny of its “re-education” campaign in Xinjiang between 2014 and 2022. Švec, who’s based at the Institute of International Relations in Prague, used official Chinese documents, state media analysis, leaked files, and international reporting to argue that international exposure played a decisive role in forcing Beijing to adjust both its narrative and its policies.

Following ethnic rioting, and a series of deadly terror attacks within and outside Xinjiang which Beijing blamed on Uyghurs, President Xi Jinping launched a “Strike Hard Campaign against Violent Extremism” in 2014 that framed Uyghur identity as a security threat. Local authorities experimented with so-called “de-extremization” centers, openly praising them in regional media. At this stage, there was little international awareness — and little effort to conceal what was happening.

That changed dramatically in 2017, when mass detentions expanded across the region. As arrests surged, Beijing imposed a strict information blackout. References to the camps disappeared from national media, and Xinjiang coverage was softened to emphasize development and stability. But outside China, journalists, researchers and Uyghur exile groups began piecing together evidence of mass incarceration.

Švec says a turning point came in late 2019 after the U.S. imposed sanctions over the repression of Uyghurs and ICIJ published the China Cables, a trove of leaked internal documents that laid bare how the camps operated. The files included detailed instructions on surveillance, discipline and indefinite detention, confirming in the Chinese government’s own words what survivors and investigators had long alleged: the camps were coercive, centrally coordinated and part of a sweeping program of mass surveillance and population control.

China, which denies human rights abuses and says religious freedom is respected in Xinjiang, responded to the China Cables investigation by decrying it as “pure fabrication and fake news.”

China Cables and a second leak published that November by the New York Times called the Xinjiang Papers — which included internal speeches and documents confirming the central authorities endorsed the mass repression — had immediate impact. Google searches for “Xinjiang” surged by 236 percent between September and December of 2019, according to Švec.

“The leaked documents and the imposition of sanctions significantly heightened the public attention on Xinjiang in late 2019,” he wrote.

According to Švec, Chinese officials reacted to the leaks as forcefully as they did to Western sanctions. State media launched aggressive attacks on critical media reports, while diplomats scrambled to counter the damage.

“In one response, the official media deemed it necessary to say that Western media ‘cannot have any actual influence’ and ‘just cannot do anything about it’. An officially published letter by a former ‘student’ of one of the camps urged Americans to ‘shut up,’ ” Švec writes.

Yet just days after the China Cables were published, authorities announced that all camp “trainees” had “graduated,” signaling an abrupt policy shift.

Recommended reading TRANSNATIONAL REPRESSION A film festival silenced — and the global reach of China’s repression Dec 23, 2025 CHINA CABLES Chinese arms flow into the US and other countries despite manufacturers’ alleged role in Xinjiang repression Dec 10, 2024 CHINA CABLES Exposed: China’s Operating Manuals for Mass Internment and Arrest by Algorithm Nov 24, 2019

03.02.2026 à 19:04

Investigation reveals how Chinese firms blindsided Malawian government over strategic mine ownership

Micah Reddy

Lire plus (461 mots)

Entities linked to the Chinese state have quietly assumed control of one of Malawi’s most strategic rare-earth mineral projects — without required oversight from Malawian authorities, an investigation by ICIJ partners PIJ Malawi, Finance Uncovered and The Continent found.

The probefocused on Mawei Mining Company Ltd., the holder of a large heavy mineral sands concession near Makanjira on the shores of Lake Malawi that are believed to contain more than 350 million tonnes of ore including zircon, titanium and monazite, a key source of rare earth elements.

Despite the government’s initial heralding of the site as a major economic opportunity with promises of jobs and infrastructure, work has largely stalled since the licence was granted in late 2017. Community leaders say they have seen no tangible benefits and that promised development projects have not materialized.

The investigation found that the ownership of Mawei’s parent company, British Virgin Islands-based Xinjin International Company Ltd., changed hands twice between 2023 and 2025, ultimately placing the project under majority control of two Chinese state-linked entities — Shandong Zhaojin Ruining Mining Industries Co. and Hainan International Resources, a regional state enterprise.

https://www.icij.org/news/2026/02/asian-financial-hubs-are-reshaping-africas-offshore-economy/

OFFSHORE Asian financial hubs are reshaping Africa’s offshore economy Feb 02, 2026

https://www.icij.org/investigations/swazi-secrets/eswatini-farmers-bank-rijkenberg-belumbu/

Recommended reading OFFSHORE Asian financial hubs are reshaping Africa’s offshore economy Feb 02, 2026 HEALTH CARE The World Bank set out to transform health care for the poor in Africa. It drove patients deeper into poverty. Jul 08, 2025 ROYAL INTERESTS The central bank in a tiny African country tried to block a suspicious banking venture. Then the king’s allies intervened. Apr 15, 2024

02.02.2026 à 18:22

Asian financial hubs are reshaping Africa’s offshore economy

Micah Reddy

Texte intégral (662 mots)

As traditional offshore havens like Switzerland tighten regulations and financial scrutiny, African elites and companies are increasingly turning to Asian financial hubs — notably Dubai, Singapore and Hong Kong — according to a recent University of Oxford

study.Capital flight exacts a heavy toll on African economies, with the continent haemorrhaging over $88 billion each year according to U.N. figures cited in the study. The three Asian financial centers are increasingly attractive destinations for this money and have become among “the fastest growing and most significant transnational connections for Africa.”

The study, a working paper that has not been peer-reviewed, was authored by Ricardo Soares de Oliveira, professor of political science at Sciences Po and a senior research fellow at Oxford.

The research “was motivated by the fact that African offshore links with Asian financial centres have massively increased over the past decade or so, but that there are few studies addressing this dynamic,” de Oliveira told the International Consortium of Investigative Journalists.

He said that: “While some financial centres have become more tightly regulated, and less accessible to African financial flows, other centers have come up to replace them. There is certainly no lack of supply to meet the demand, and no reason to believe that hiding money abroad has become more difficult.”

https://www.icij.org/investigations/swazi-secrets/eswatini-mswati-economic-zone-gold-dubai/

Recommended reading SWAZI SECRETS How international gold dealers exploited a tiny African kingdom’s economic dream Apr 15, 2024 FINANCIAL SECRECY From Dubai to Toronto, inside the crypto-to-cash storefronts fueling money laundering’s new frontier Nov 17, 2025 Corruption As Equatorial Guinea burned through oil riches, millions were funneled to a company owned by its ‘playboy prince’ May 08, 2025

r this hesitation,” de Oliveira argues, “but vested interests by those who benefit personally from offshore strategies is one of them.”And despite the shift towards Asia, Western jurisdictions and firms remain central players in the offshore world. The offshore industry is completely interwoven and both Western and Asian offshore centers, the report notes, “function in strikingly similar manners,” while Western blue-chip companies remain key players in Asian offshore markets.

Though the rise of the trio of Asian financial hubs is widely seen as “a new post-West business arrangement” unconstrained by “good governance moralizing” and “practical barriers,” the study suggests that these trends do not signal an entirely separate and competing offshore system. Instead, this represents the expansion and diversification of an existing global offshore network.

Reforms to curb illicit financial flows, says de Oliveira, therefore “need to be truly global.”

“If they are not, tightening up in some jurisdictions merely shifts business away to other more permissive jurisdictions. If their home countries become more demanding, Western service providers are happy to follow the business and expand their footprint in the new locations.”

29.01.2026 à 18:23

New EU report urges more aggressive action against transnational repression

Carmen Molina Acosta

Texte intégral (505 mots)

Europe must take a coordinated response to fight the rising threat of transnational repression, according to a group of experts commissioned by the European Parliament to investigate ways to counter this emerging form of cross-border authoritarian coercion.

A new study commissioned by the European Parliament

, which cites ICIJ’s China Targetsinvestigation, details a set of policy recommendations for the European Union and its member states aimed at closing gaps in protection and accountability.

Chief among recommendations are the development of an EU-wide definition of transnational repression, the creation of an internal data collection and knowledge hub on the issue within the bloc, and strengthened communication channels between member states’ law enforcement agencies.

“There is a need, broadly speaking, that there be more and better data collection on transnational repression, whether it is done at the multilateral or state level,” Nate Schenkkan, the lead author of the report, told ICIJ. “The knowledge drives action, so collecting the information and disseminating it is part of the process and policy framework of forcing those other stakeholders to address the issues.”

The report recommends strengthening data protection clauses in EU laws, including identifying transnational repression as a “systemic risk” that regulated platforms are responsible for under the Digital Services Act. It also calls for more aggressive action to counter transnational repression, including visa bans, the expulsion of diplomats, and swifter mobilization of sanctions.

Recommended reading TRANSNATIONAL REPRESSION A film festival silenced — and the global reach of China’s repression Dec 23, 2025 PROTESTS As President Xi Jinping traveled the world, police swept peaceful protesters off the streets Apr 29, 2025 CHINA TARGETS New UN report highlights China’s alleged targeting of human rights activists Oct 15, 2025

29.01.2026 à 12:06

Auditors at Bitpanda’s German subsidiary flagged information security issues, echoing regulator’s concerns

Scilla Alecci

Lire plus (461 mots)

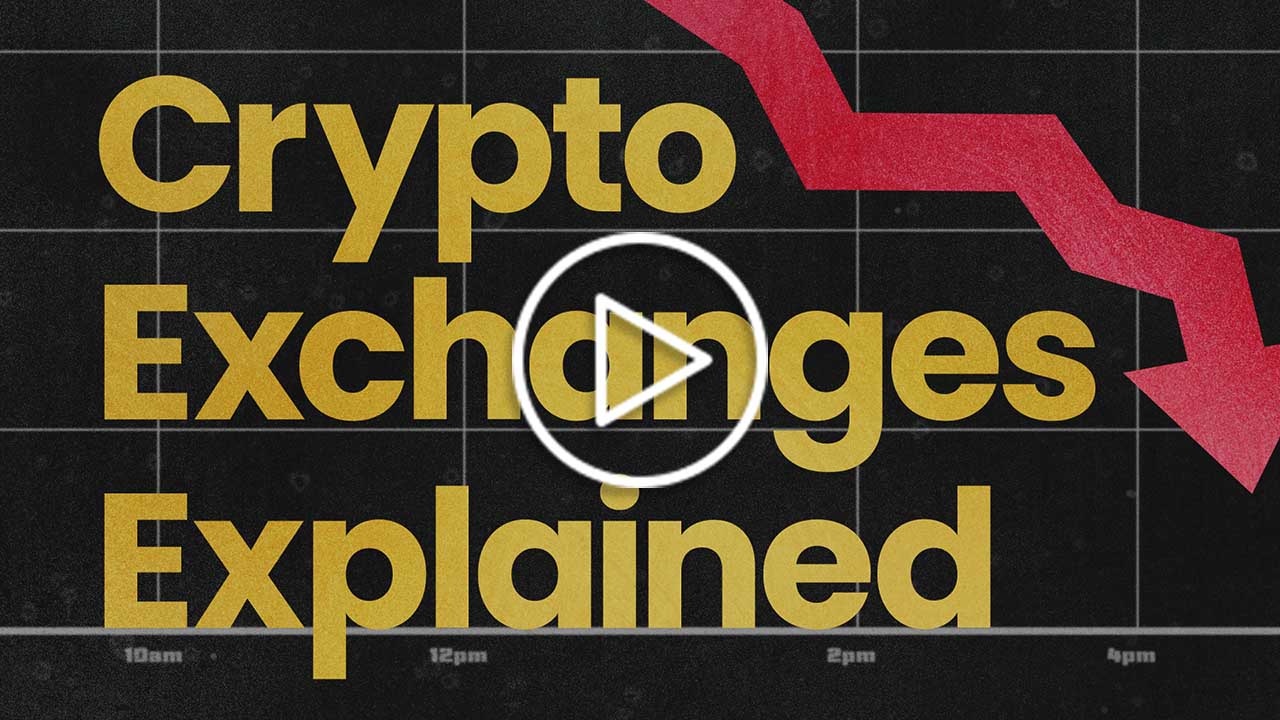

Bitpanda prides itself on being one of the most regulated crypto exchanges in Europe. The Austrian firm — backed by investors including billionaire Peter Thiel and reportedly planning for a listing on the Frankfurt stock exchange this year — has promoted its services with the slogan “secure, regulated and real.”

But reporting by Süddeutsche Zeitung, WDR and NDR, in Germany, and profil magazine, in Austria, found that internal auditors of Bitpanda’s German-licensed subsidiary, Bitpanda Asset Management GmbH, raised red flags last year about the Berlin firm’s operations. The warnings came months after the subsidiary had assured Germany’s Federal Financial Supervisory Authority, or BaFin, it had addressed concerns raised by the regulator following a routine audit.

The new findings by media partners of the International Consortium of Investigative Journalists are part of The Coin Laundry, an ICIJ-led exposé into the lightly regulated crypto industry. They highlight regulators’ difficulties in holding crypto companies to the same customer care and risk management standards as banks and other traditional financial institutions.

https://www.icij.org/investigations/coin-laundry/video-cryptocurrency-exchanges-explainer/

VIDEO WATCH: Cryptocurrency exchanges, explained Nov 17, 2025

CRYPTOCURRENCY Retailers keep cashing in on crypto ATMs as scams surge Dec 17, 2025

Recommended reading CRYPTOCURRENCY Crypto giants moved billions linked to money launderers, drug traffickers and North Korean hackers Nov 17, 2025 VIDEO WATCH: Cryptocurrency exchanges, explained Nov 17, 2025 CRYPTOCURRENCY Retailers keep cashing in on crypto ATMs as scams surge Dec 17, 2025

- GÉNÉRALISTES

- Le Canard Enchaîné

- La Croix

- Le Figaro

- France 24

- France-Culture

- FTVI

- HuffPost

- L'Humanité

- LCP / Public Senat

- Le Media

- La Tribune

- Time France

- EUROPE ‧ RUSSIE

- Courrier Europe Centrale

- Desk-Russie

- Euractiv

- Euronews

- Toute l'Europe

- Afrique du Nord ‧ Proche-Orient

- Haaretz

- Info Asie

- Inkyfada

- Jeune Afrique

- Kurdistan au féminin

- L'Orient - Le Jour

- Orient XXI

- Rojava I.C

- INTERNATIONAL

- CADTM

- Courrier International

- Equaltimes

- Global Voices

- I.R.I.S

- The New-York Times

- OSINT ‧ INVESTIGATION

- OFF Investigation

- OpenFacto°

- Bellingcat

- Disclose

- Global.Inv.Journalism

- I.C.I.J

- MÉDIAS D'OPINION

- Au Poste

- Cause Commune

- CrimethInc.

- Hors-Serie

- L'Insoumission

- Là-bas si j'y suis

- Les Jours

- LVSL

- Politis

- Quartier Général

- Rapports de force

- Reflets

- Reseau Bastille

- StreetPress

- OBSERVATOIRES

- Armements

- Acrimed

- Catastrophes naturelles

- Conspis

- Culture

- Curation IA

- Extrême-droite

- Human Rights Watch

- Inégalités

- Information

- Justice fiscale

- Liberté de création

- Multinationales

- Situationnisme

- Sondages

- Street-Médics

- Routes de la Soie